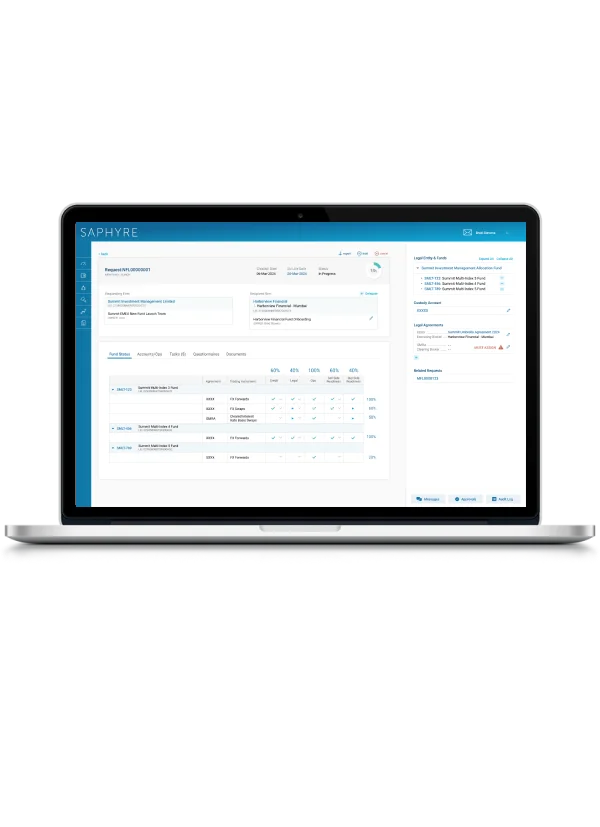

Broker Trading Account Onboarding & Maintenance

Collaboratively onboard and maintain accounts with synchronized activities, progress tracking, and custom workflow tools.

Expedite onboarding and maintenance of accounts

Saphyre utilizes patented AI and automated workflow capabilities to streamline the onboarding of new or existing accounts across all your clients / counterparties. Track progress by agreement and trading instrument and know immediately when funds are ready-to-trade. With Saphyre, dramatically reduce email traffic, speed onboarding time, and increase data integrity through the lifecycle of each fund.

Product Details

Fund/Account Onboarding

Launch onboarding workflows for new or existing trading accounts with one or more counterparties. Track progress at the trading instrument level across KYC, tax, legal, credit, and operations teams. Includes GLEIF integration, operational account ID mapping, and legal agreement tracking.

Ready-to-Trade Monitoring

Full transparency to real time fund readiness by market/currency, trading instrument, EMS/OMS setup, and SSI status (enriched by DTCC’s Alert). Alerts for critical issues such as missing SSIs, GLEIF registration expiration, incomplete legal agreements, KYC issues, or compliance events (e.g. NAV terminations)

Dashboards & Reports

Portfolio Launch Dashboard tracks each fund’s associated workflows and their statuses. Fund/Account Go-Live Status Report tracks onboarding progress via a filterable list view of funds sorted by go-live status.

Proactive Fund/Account Maintenance

Saphyre tracks data and document validity and provides warnings for critical maintenance activities such as document expiration or when KYC refreshes are required.

Lifetime Fund/Account Management

View a filterable list of all funds and their associated details, and easily adjust in real time when needed.

All Saphyre solutions are built on our patented, AI-powered platform which includes:

- Data Normalization

- Automated Data Enrichment

- Cloud Document Management

- Strict Permissioning

- In-Context Messaging

- Standard & Custom Questionnaires

- Automated Task Lists

- Maker/Checker Verification

- Comprehensive Audit Log

- Reporting, Metrics, & Analytics

Problem Space

Too many manual processes

Result in errors, long onboarding times, high costs, and delayed revenue

Difficulty tracking documents

Unsure what has been received, where it is stored, and if it is up to date

Significant operational risk

Due to limited view and control of counterparty activities

Lack of status transparency

Holds up progress across both internal and external teams

Key Benefits

Streamline activities for increased efficiency

Cut emails and phone calls in half and eliminate rekeying of data in multiple systems/to multiple parties

Full transparency

One platform to organize and manage all accounts, data, documents, and requests means always knowing exactly where things are, and what specific activities are held up

Increase Workload Capacity

Handle more work and reduce reliance on offshore teams to scale your organization

Improve customer satisfaction

Impress clients with easy-to-use digitized workflows and access to dashboards that allow them to easily track progress

Drive business growth

Investment Managers easily see which firms turn requests around fastest, allowing brokers to drive more volume and attract new customers

Trade faster

Complete onboarding in hours not days or weeks. Shift time savings into revenue opportunities

Reduce post-trade errors

Proper pre-trade setup significantly reduces downstream issues

Save time & money

Fewer trade exceptions to handle means less time/effort and resources needed to troubleshoot and resolve issues