Securities Funding Management

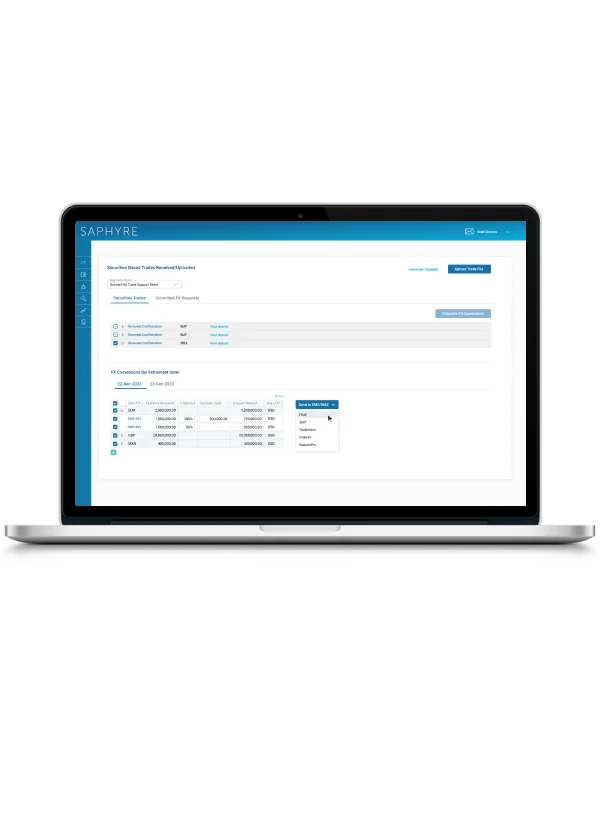

Calculate FX required to fund securities trades and send to trading platform to secure competitive pricing.

Manage your firm’s liquidity efficiently and meet T+1 compliance effortlessly

Saphyre enables buy sides to instantly identify their exact currency needs for affirmed securities trades and seamlessly go to liquidity providers for competitive pricing just once at the end of the day, streamlining and simplifying the process. Saphyre keeps all the trade details linked and status transparent, so all parties involved have the context they need for efficient processing.

Product Details

FX Obligation Calculator

Selected affirmed securities trades are aggregated and the required FX is instantly calculated to satisfy all obligations (with any standing instructions automatically removed)

Direct Link to OMS/EMS

Once calculated, FX obligations can be sent directly to your preferred order management system

Confirmation Management

Changes can be made to trade details as needed, and trades can be affirmed when ready. FX trades are linked directly to the securities trades they fulfill, providing transparency to all parties involved (including the custodian)

Instant Place of Settlement (PSET) Updates

Bulk update PSET to quickly adjust all SSIs when needed

All Saphyre solutions are built on our patented, AI-powered platform which includes:

- Data Normalization

- Automated Data Enrichment

- Cloud Document Management

- Strict Permissioning

- In-Context Messaging

- Standard & Custom Questionnaires

- Automated Task Lists

- Maker/Checker Verification

- Comprehensive Audit Log

- Reporting, Metrics, & Analytics

Problem Space

Hard to get the best rate

It's a struggle to get competitive rates for post-4pm eastern time FX liquidity

Increasing trade costs

With T+1 regulations, the new time crunch is poised to increase trade costs due to reliance on unfavorable rates and increased operational overhead, creating significant organizational challenges

Difficult to monitor cash flow

Precise liquidity forecasting is required for timely settlement of trades

Key Benefits

Obtain best execution

Enables buy sides to get the best price for FX trades by forwarding the FX required transaction to OMS/EMS platforms with a vast selection of liquidity providers.

Maximize time and cost savings

Saphyre aggregates/nets orders at the buy side’s chosen time of day (one trade per currency pair)

Full straight through processing (STP)

Allocations for buy sides can process effortlessly, start to finish

Prevent disruptions to standing instruction flow

Saphyre considers buy side’s custodial standing instructions and omits trades more efficiently executed by the custodian from trades routed to OMS/EMS platforms.

Avoid settlement delays

Full, real-time transparency to all parties via a single, centralized view. In addition, Saphyre’s comprehensive database of authenticated SSIs mitigates settlement inefficiencies and ensures timely settlement.

Increased efficiency for Liquidity Providers

Affirm allocations and settle trades promptly. With verified fund and SSI details readily available, most post-trade exceptions that could hold up trades are eliminated.

New FX trade flow for Liquidity Providers

Increased access to FX trade opportunities. In EMEA alone, $70 billion in FX trades are needed per day.

Lower costs for Custodians

Because account information, SSIs, and trade data is stored on Saphyre instructions can be messaged directly to the various participants (CTM provider, Liquidity Providers), reducing reliance on SWIFT

Increased transparency for Custodians

With immediate settlement and real-time visibility into the full context of each trade, empower custodians to manage settlements confidently and efficiently