Trade Exception & Confirmation Management

Proactively manage and resolve issues across all asset classes that could prevent you from being able to allocate and settle successfully

Handle critical trade issues in real-time across all counterparties

Saphyre tracks issues, identifies root causes, and provides real-time collaborative workflows to quickly resolve complex trade exception issues with all related counterparties, eliminating the need for time and resource intensive callbacks. Saphyre also allows firms to easily review, edit, and affirm trade confirmations for timely settlement.

Product Details

Robust Issue Tracking

Track and notify on multiple different issue types that can cause downstream problems such as allocation errors, trade mismatches, place of settlement issues, inventory issues, missing or incomplete SSIs, when funds are not yet created or ready for trading, inactive or expired GLEIF status, KYC document expirations, missing OMS/EMS account information, markets not yet open for trading, NAV termination events, etc

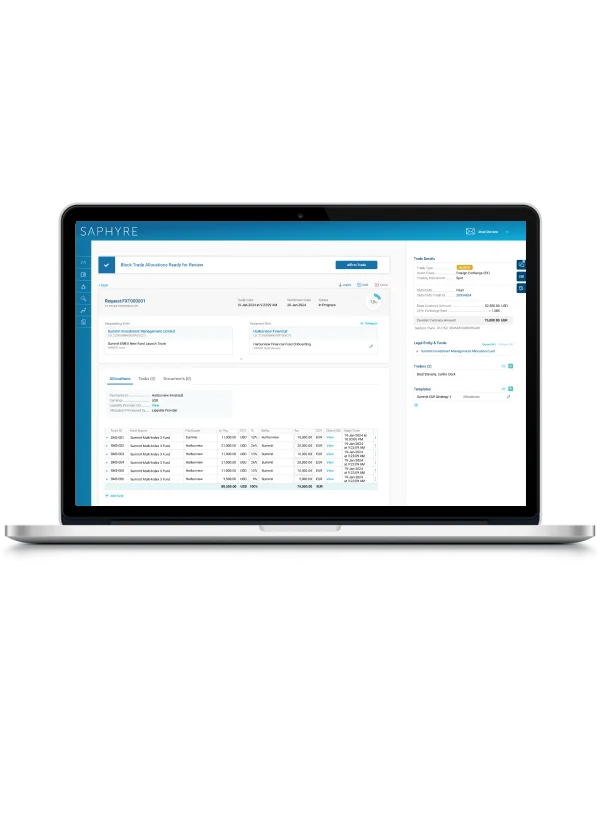

Trade Exception Dashboard

Uncover issues across all asset classes in a single, asset class agnostic dashboard, allowing issues to be reviewed and resolved immediately with full status transparency

Collaborative Issue Resolution

Quickly launch in-context workflows between buy and sell-side post-trade support teams to resolve issues

Front Office Escalation

If post-trade support teams cannot reach a resolution, there’s an easy escalation path to the front office teams so those who perform the trade can resolve it in real-time

Trade Confirmation Management

Buy and sell sides can easily review trade details, including fund/market readiness for each allocation, with the ability to resolve issues or edit allocations where needed, and once ready, affirm trades

All Saphyre solutions are built on our patented, AI-powered platform which includes:

- Data Normalization

- Automated Data Enrichment

- Cloud Document Management

- Strict Permissioning

- In-Context Messaging

- Standard & Custom Questionnaires

- Automated Task Lists

- Maker/Checker Verification

- Comprehensive Audit Log

- Reporting, Metrics, & Analytics

Problem Space

Affirmed trades not settling

Frequently firms believe that if they’ve affirmed a trade, then the trade will settle, but there are still many issues that can occur during the trade lifecycle.

Extreme complexity

Difficult to resolve exceptions when they need to be resolved across multiple intertwined but not directly connected parties.

Difficulty achieving T+1

With the increasing pressure to settle in a shrinking time window, firms can no longer rely on traditional manual methods to manage and resolve the growing number of trade exceptions

Key Benefits

Avoid settlement disruptions

Fix and resolve exceptions that occur in real time so trades can be settled immediately

Save Time & Money

Reduce time and effort spent working on researching root-cause of issues

Eliminate callbacks

Improve trade velocity by removing the need to reach out directly to clients to verify information

Grow your businesses

Improve service levels impress clients and drive more trade volume

Achieve T+1 with ease

Avoid compliance issues and potential penalties